What is a mutual fund? The answer is clear to all. A mutual fund is medium. It pool s money from investors and provides them securities about money. Then they invest the money in various assets. For example, we can mention- bonds, stocks, money market instruments, etc.

Usually, money managers are responsible for the central management of mutual funds. As a result, they are very professional in handling these matters. In mutual funds, mainly retails and industrials are the investors from their money managers pools money to invest. As the mutual fund has both advantages and disadvantages, it is vital to use intelligence here. Moreover, yearly fees and commissions are other factors in a mutual fund. As many things are huge in mutual funds, we will write all these things in this article. As a result, you will get the answer to the question ‘What is a Mutual Fund.’

Table of Contents

What is a Mutual Fund?- Now and Then

The birthplace of mutual funds in the United States of America. The time was 1890 when people knew What is a Mutual Fund. Funds in that time followed the concept of closed-end funds. Moreover, share’s numbers with these were fixed. All these dealt in a higher price. Even it was higher than the net value of the assets prize. On 21st March 1924, the concept of the open-end mutual fund came to an introduction. Massachusetts Investors Trust formed this. These investors are still active, and MFS Investment Management manages them.

In 1929 A major stock market crash occurred in America. It was the Wall Street Crash in 1929. At that time, the United States Congress had passed rules for market securities and mutual funds. As these rules and regulations were not in favor of closed-end funds, open-end funds became popular. At the beginning of 1980, the mutual fund grew largely, and this growth remains till now. Since 2003 the assets in mutual funds raised. Though 2008 and 2011 was an exceptional year.

Present Situation of Mutual Fund-

At present total mutual fund assets is $54.9 trillion. Many countries invested in this sector in 2019, and there are.

- The United States of America has invested $26.7 trillion in total.

- Australia has invested $5.3 trillion in total.

- Ireland has invested $3.4 trillion in total.

- Germany has invested $2.5 trillion in total.

- Luxembourg has invested $2.2 trillion in total.

- France has invested $2.2 trillion in total.

- Japan has invested $2.1 trillion in total.

- Canada has invested $1.9 trillion in total.

- The United Kingdom has invested $1.9 trillion in total.

- China has invested $1.4 trillion in total.

The United States of America is the number one on the list, as their household finances have is impacted by it. Moreover, 23 percent of these assets have been held in mutual funds. the largest managers of mutual fund in the United States are listed below-

- Vanguard Group has $4.7 trillion in assets.

- Fidelity has $1.7 trillion in assets.

- BlackRock has $1.7 trillion in assets.

- Capital Group has $1.6 trillion in assets.

- T. Rowe Price has $0.7 trillion in assets.

- State Street has $0.6 trillion in assets.

- Dimensional has $0.4 trillion in assets.

- JPMorgan Asset Management has $0.4 trillion in assets.

- Franklin Templeton Group has $0.3 trillion in assets.

- Invesco has $0.3 trillion in assets.

What is a Mutual Fund?- The Definition and Understanding:

Generally, mutual funds have two steps. Firstly, managers pool money from industries, and industries are ready to invest. Secondly, use this money to buy securities like bonds and stocks. Some key concepts of mutual funds are explained here-

Firstly it is a vehicle between the investors and the portfolio of bonds, stocks, shares, etc. Secondly, It gives the individual and small investors a diversity of professional files at a reasonable price. Thirdly, mutual funds have several categories. As a result, any investor can select the suitable one for themselves. Fourthly, yearly fees, commissions are parts of mutual funds. It is better to think about returns, including these. Lastly, you should always remember that mutual funds have both advantages and disadvantages.

Some key terms to understand – What is a Mutual Fund?

Before investing in a mutual fund, it is vital to know the whole concept. To understand that, you require some prior knowledge about some key terms. So in this section, we are going to discuss that.

The average annual total return-

A company, retail, or industry invest in a mutual fund to get back something from that. There is a formula to compute the average annual total return, and it is-

P(1+T)n = ERV

Here P is a hypothetical initial payment, and it is $1,000.

T is the average annual total return, which we want to determine.

N is the number of years.

ERV stands for ending redeemable value. It is the hypothetical $1,000 which is paid initially.

Net asset value

The second key term is Net asset value. It is also known as NAV. Moreover, this term indicates asset liabilities. It is the difference between the fund’s holdings and the fund’s liability. So the formula stands for-.

NAV= fund’s holdings – the fund’s liability

The expression for NAV is a per-share amount. It is the division of the net assets and fund shares outstanding numbers. Moreover, there are some rules for the computation of the net assets of a fund. In the most of the case, assets calculate their business day based on a single business day.

Market capitalization

It is the multiplication of fund shares outstanding numbers and the stock’s market price. It represents a companies size. Here listed traditional ranges for market capitalizations-

- Mega cap – It indicates the companies are worth $200 billion or more in market capitalizations.

- Big/large-It means the cap – companies worth between $10 billion and $200 billion in market capitalizations.

- Mid-cap – It indicates the companies worth between $2 billion and $10 billion in market capitalizations.

- Small-cap – It indicates the companies worth between $300 million and $2 billion in market capitalizations.

- Microcap – It indicates the companies worth between $50 million and $300 million in market capitalizations.

- Nano cap – It indicates the companies worth less than $50 million in market capitalizations.

Portfolio Turnover

It indicates the volume of securities trading of a fund. Moreover, it is a portfolio’s long-term securities’ average market value. For a short period, like less than one year, it is annualized.

Share classes

There are different combinations for investors in a mutual fund. These combinations are made by combing back-end loads, front-end loads services, and distribution fees. As they offer other shares, there are some share classes. Traditional share classes are-

- Class A- These types of shares require the charge of front-end sales. Moreover, they offer low distribution and service fees for investors.

- Class B- These types of shares don’t require the charge of front-end sales. Instead of that, they need a high contingent deferred sales charge (CDSC). It reduces over the years. Then it combines with the 12b-1 fee. These shares automatically convert to Class A type shares after a certain period.

- Class C- These types f shares require high distribution and service fees. It also has a modest contingent deferred sales charge (CDSC). It doesn’t continue after passing one or two years. These shares rarely convert to other classes. Moreover, shares from this class are also called “level load” shares.

- Class I- These types of shares’ classes are high, though they have minimum investment requirements. The other name of these shares is “institutional” shares. Moreover, class-I is no-load shares.

- Class R – These types of shares do not require any charges for the load. But they need minimum distribution and service fees. As a result, This class is the perfect option for planning about retirement, like 401(k) plans.

- Class N- These types of shares charge 0.25% of an asset’s fund for distribution and service fees.

Advantages and Disadvantages of Mutual Funds-

As we mentioned all key terms related to mutual funds, you know a mutual fund. Mutual funds have both advantages and disadvantages. Now it’s time to know about these advantages and disadvantages. They are explained below-

Advantages of a mutual fund-

- As a mutual fund expands diversification, risks are automatically reduced for that. There are diverse options for assets to invest in.

- It is possible to redeem NAV within seven days in the united states. In reality, usually, it is a much faster process. Sometimes this liquidity brings asset–liability mismatch. So for this issue, there is a liquidity management rule of SEC passed in 2016.

- Another advantage of mutual funds is that very professional managers handle the funds. As a result, they wisely utilize the funds for the investors.

- A mutual fund is for all types of investors. It helps individual investors to invest like large industries. As a result, they become capable of investing in foreign markets.

- When an investor invests in mutual funds, it achieves many easy and services. Usually, funds often provide these services.

- To make a mutual fund safer, the government has lots of rules and regulations. Investors, managers, and assets everyone follows these rules.

- Mutual funds have some specific information, and all mutual funds have to present those to the investors. As a result, funds look very transparent to the investors. Moreover, they can easily compare these funds with their requirements.

Disadvantages of Mutual Fund-

There are some disadvantages of mutual funds, and they are-

- Investors have to pay for mutual fund expenses and fees to hold a mutual fund. These expenses and fees include different types of costs.

- When capital achieves in a mutual fund, there comes a tax against it.

- Like other investments, there is the chance of achieving less profit in a mutual fund. Returns can fluctuate at any time in a mutual fund.

- Investors have less control over goal-achieving time.

- Once investors invest in a fund, they can not customize it anymore.

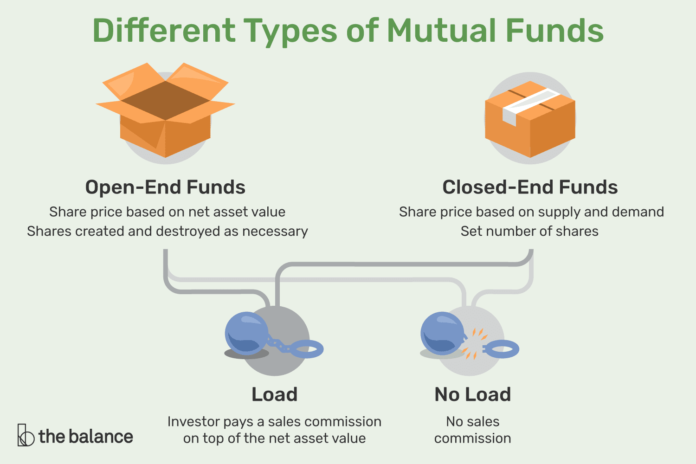

Types of Mutual Funds-

Mutual funds are categorized based on different things. These categories depend on principle investments, types of securities, and many more. Some of these categories are-

Money market funds

These funds invest in the tools of the money market. It is a high-quality fund that requires a short maturity time. Moreover, income securities are fixed in money market funds. As these types of funds are for institutional investors, they invest in non-government assets.

Bond funds

The characteristics of Bond funds are-

- Firstly, The different types of bonds are owned. For example, we can mention- junk bonds, corporate bonds, government bonds, etc.)

- Secondly, Different types of maturity times are required for the bonds. It can hold in the short-term, intermediate-term, or long-term.

- Thirdly, it is a fund to invest in debt securities.

- Lastly, it provides fixed-income securities.

Stock funds-

The key point of Stock funds are listed below-

- Also known as equity funds.

- Investments occur in common stocks.

- Certain industries ‘ stocks get priority.

- There are specified countries and regions for stocks.

- As a result, Company’s stocks grow very strongly.

- Moreover, you can pay for the stocks by sharing, and it increases the income.

Hybrid funds

These types of funds are for those investors who want to invest in both stocks and bonds. The main characteristics of these funds are given below-

- These are the balanced funds.

- Assets are allocated in these funds.

- There is a target date for these funds.

- Sometimes there is a targeted risk for the funds.

- The structure of a hybrid fund is the fund to fund.

- Funds can be affiliated or unaffiliated. Moreover, the combination of both affiliated and unaffiliated works here.

Conclusion

One of the vital focal points of putting resources into a shared asset is that every financial backer (even with a little venture) gains entry to proficient cash the board and mastery. Likewise, it would be hard for a financial backer to make a widen arrangement of ventures all alone with a modest quantity of cash. With shared assets, every financial backer partakes relatively in the return the plan produces.

However, I hope you got a slight of info on what is a mutual fund query.

Every unit gets a relative portion of the gain (or bears misfortune) from the asset. A portfolio report is produced for every financial backer, which tracks all ventures and the profits created by the common asset. Anyway, after getting this detailed guide on what is a mutual fund, we guess you can invest your money safely.